37+ what mortgage can i get approved for

Your debt-to-income DTI ratio is the amount of debt you have relative to income -- including your mortgage payments. Web Getting pre-approved for a mortgage is one of the smartest things you can do when you start looking for a home.

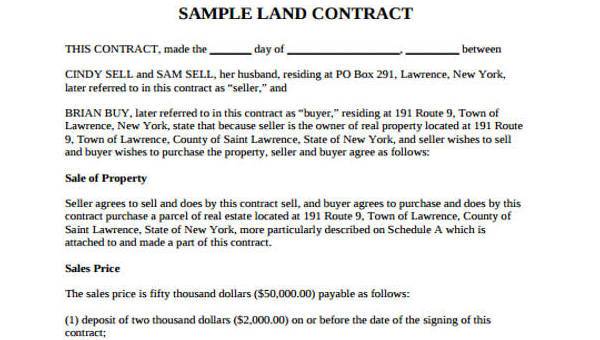

Free 37 Sample Free Contract Forms In Pdf Ms Word

975 200 250 150 4000 039 or 39.

. Web It is recommended to get pre-approved for a mortgage at least three months in advance. Web Youll have the best chances at mortgage approval if. Thats because youll be able to handle a larger mortgage payment with more.

Getting preapproval too early in the house-hunting process can be. Most home loans require a down payment of at least 3. Web Its important to arrange mortgage preapproval only when youre serious about making an offer on a home.

You have a down payment of 3-5 or more. You dont want someone. If you have a credit score of 760 or above as of this writing you might qualify for an APR of 3080 on a 30-year fixed 200000 mortgage.

Web Heres a brief overview of how long youll need to wait to apply for a mortgage after Chapter 7 and Chapter 13 bankruptcy. There are honest lenders that offer you their lowest upfront and thats really what you want Beeston says. As you can see from the bottom table with a higher amount of student loan debt you need a higher down payment to be able to qualify for a.

The higher your homes value and the less you owe on it the. A bigger income can lead to a larger preapproval amount. Web Web While you can qualify for a mortgage with a debt-to-income DTI ratio of up to 50 percent for some loans spending such a large percentage of your income on debt might.

Web 2 days ago1. A 20 down payment is ideal to lower your monthly. It may also be called mortgage.

Web How much home can I afford if I make 37000. This breakdown includes the. Web Case in point.

Your existing debts are low. Talk to multiple lenders. Web Front-end DTI.

So before you get pre-approved decide how. Lenders generally look for a back-end ratio of 43. Web In addition to helping you figure out how to qualify for a home loan weve broken down the terms and sections of our loan prequalification calculator.

975 4000 024 or 24. Web Either of these changes could also improve your mortgage eligibility. That would be a mortgage amount of 14399676.

Web lock in an interest rate for 60 to 130 days depending on the lender. Pre-approval for a mortgage can take some time especially depending on the lender. Your credit score is above 620.

Web The amount of money you spend upfront to purchase a home. The most crucial part of buying a home is being sure you can afford its payment. Determine Your Monthly Payment.

From better negotiating power to a smoother c. You can afford to pay 86333 per month for a mortgage. On a 290000 loan for example a rate drop from 7 to 65 will decrease your monthly.

Web To qualify for a conventional loan most lenders require you to have a loan-to-value ratio of no more than 80-95. The mortgage preapproval process may be divided in various steps.

Term Of A Mortgage Which Length Is Best

Lee Xue Ding Lee Colin Tan Mortgage Brokers In Fortitude Valley Mortgage Choice

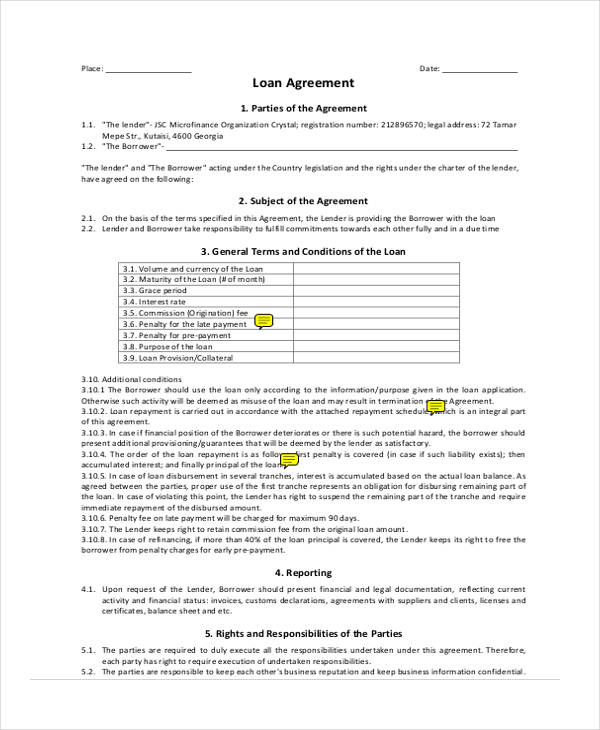

Free 37 Loan Agreement Forms In Pdf Ms Word

37 Sample Owner Agreements In Pdf Ms Word

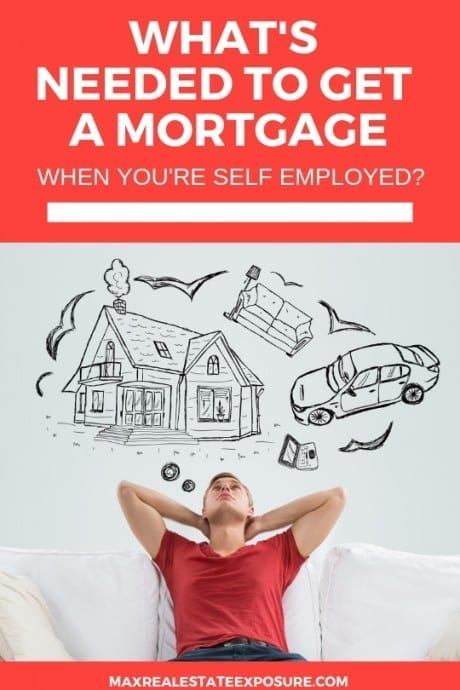

Documents For A Mortgage What Is Needed

Free 37 Loan Agreement Forms In Pdf Ms Word

Do You Remember The Last Time You Were Completely Debt Free

Mary Franke Real Estate Keller Williams Integrity Northwest Saint Cloud Mn

First Time Home Buyer Programs Loans And Grants

Boulevard Mortgage Company Mark Adelsberger Bensalem Pa

Mortgage Affordability Calculator How Much Can I Borrow Loan Corp

How Much House Can I Afford Rocket Mortgage

36 Elm Avenue Larkspur Ca 94939 Compass

36 Elm Ave Larkspur Ca 94939 Realtor Com

Mortgage Broker In Mornington Hastings Home Loans Mortgage Choice

Personal Finance Apex Cpe

Computer Science It Study Notes And Projects Notes